The global green economy covers a diverse range of activities, and whilst all have performed well in recent years, the research from FTSE Russell Green Revenue data finds it lagging in some areas compared to previous performance.

The green stocks have outperformed the wider market and the oil and gas sector by some margin in the last few years, with the FTSE Environmental Opportunities All Share (EOAS) Index, which measures the performance of companies with at least 20 per cent of their revenues derived from environmental products and services, outperforming the FTSE Global All Cap, by 9.7 per cent over the last three years, and 5.9 per cent over the last five years.

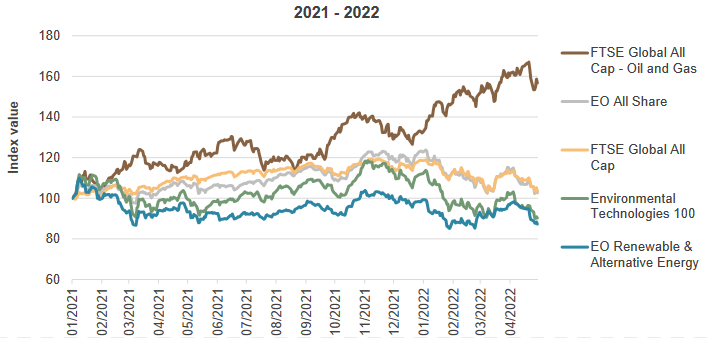

However, this strong performance is not universal across the whole of the green economy, and certain green subsectors, such as renewable energy, have in particular suffered of late. For instance, while the renewable & alternative energy sector is often assumed to dominate the green economy, its performance since 2008 is muted compared to other green sectors, particularly energy efficiency and water technologies, which saw consistently stronger growth from 2008 to 2022.

The full finding are published in the Investing in the Green Economy Insights 2022 report, which concludes that although the short-term performance of the environmental markets is currently challenging, it is unclear whether this weak performance will unfold into a longer-term trend, largely because many of the drivers of the green economy’s strong long-term performance remain: an increasing focus on climate finance, investors becoming increasingly interested in sustainable investment and green taxonomies coming into force.

Latest News

-

Tottenham Hotspur and charities launch film to tackle mental health stigma

-

Russell Hobbs launches food poverty campaign in schools

-

Cardfactory funds homelessness charity’s team of psychologists

-

Bingo firm raises £300,000 for the Stroke Association

-

Sainsbury’s links up with Comic Relief for festive recipe campaign

-

Shepherd Neame extends air ambulance charity partnership

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories