The German government is issuing green bonds under a new concept of ‘twin’ bonds to avoid negative effects of illiquidity. It also makes it easier for there to be a natural diversification between conventional and green bond investors.

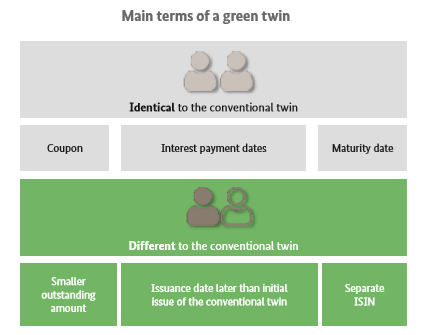

Green twin bonds are issued with the same maturity and coupon as a ‘twin’ conventional bond. The green bond is a separate bond with a smaller issue volume than the conventional bond.

Germany has become the third AAA-rated country to issue a green government bond after the Netherlands and Sweden. The German government also announced its commitment to building a full green yield curve, next to its conventional yield curve.

Commenting on the concept, Bram Bos, lead portfolio manager green bonds at NN Investment Partners said, “The concept of ‘Green Twin Bonds’ is a new and innovative form of green bond issuance we favour. We think this concept is a much better option than the concept currently being explored by the Danish government, which is looking to issue separate green labels or stickers which could be attached to any conventional bond.”

On 2 September, Germany issued €6.5bn worth of bonds with a maturity of 10 years. In contrast to some other countries, like the Netherlands, Belgium and France, the German government plans to build a full yield curve. This gives investors more options to greenify their fixed income portfolio at several different points along the yield curve. After this inaugural green bond, Germany is expected to be a regular issuer, issuing around € 10bn per year in green bonds.

Germany has identified five sectors to which they can allocate the proceeds of their green bonds. These are transport; international cooperation; research, innovation and awareness raising; energy and industry; and agriculture, forestry, natural landscapes and biodiversity.

However, Bos notes that the country’s green bond framework is not as clearly aligned with international standards, like the Green Bond Principles and the EU and Climate bond Initiative taxonomies, as some other green government bonds. Bos comments that,. “For example, a large portion of these green bond proceeds will be allocated to trains and rail infrastructure, which could also include the freight transport of fossil fuels. We miss the ‘do no harm’ assessment in this green bond framework, which is one of the pillars of the EU taxonomy and EU Green Bond standard.”

Latest News

-

Private health provider awards £10,000 to arthritis research team

-

Building Society hands out £1m to tackle inequality

-

Premier League and Comic Relief partnership aims to improve children’s mental health

-

Russell Hobbs launches food poverty campaign in schools

-

Tottenham Hotspur and charities launch film to tackle mental health stigma

-

Cardfactory funds homelessness charity’s team of psychologists

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories