Norway’s Norges Bank Investment Management (NBIM), which is responsible for the investments of the Government Pension Fund Global, is stepping up is scrutiny of financial disclosures that relate to climate change.

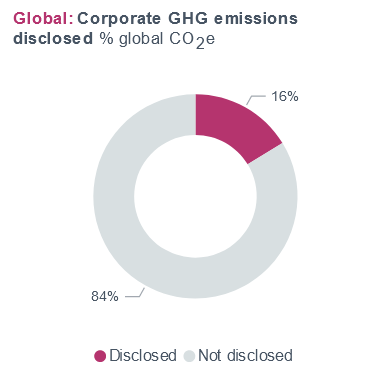

Norway's $1.35tr wealth fund will be calling for mandatory disclosure requirements to listed and unlisted entities over time, a move that it said was important for creating a level playing field and for accurate reporting of scope 3 emissions. The fund will now increase its engagement with companies over climate risk and will actively voting against board members that the fund believes are not doing enough to curb emissions and report.

"We prioritise the largest emitters, and these account for about 70 per cent of the emissions in the portfolio. Climate considerations is always part of the engagements we have with these companies. Among several topics, we discuss the companies’ climate targets, transition plans and emission pathways. We set concrete goals and follow the progress over time", said Carine Smith Ihenacho, chief governance and compliance officer.

The fund said fund has also issued a response to the Australian government’s consultation on climate-related financial disclosures, urging Australian regulators and standard-setting bodies to set mandatory requirements for climate-relating reporting based on the forthcoming International Sustainability Standards Board (ISSB) standards.

“Australia’s alignment with international standards is essential both to retain access to global capital markets and to minimise compliance costs for Australian businesses operating cross-border,” NBIM stated.

However, NBIM recognised the implementation challenges, and therefore supported phasing in the requirements over time.

Latest News

-

Jewellers body offers grants of up to £50,000 to boost training

-

Agency overhauls community charity’s brand for free

-

Open University launches global majority voluntary sector leadership programme

-

OVO and Co-op’s foundations help launch youth climate justice funding scheme

-

Bus firm to invest £25m in green transport research

-

Myanmar earthquake: Co-operative bank launches emergency fundraising appeal

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories