The world’s largest asset managers are off track to meet their own 2050 net-zero commitments, according to a new study released by think tank FinanceMap.

The analysis finds that the world’s largest asset managers have not improved their climate performance over the past two years and in some cases have reversed positive trends, despite most having set net-zero by 2050 targets through initiatives such as the Net Zero Asset Managers (NZAM).

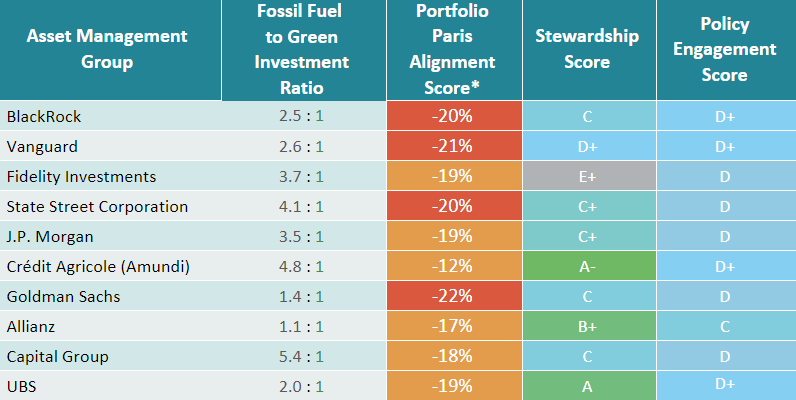

FinanceMap’s Asset Managers and Climate Change 2023 report scores 45 of the largest asset management companies based on three criteria: equity portfolio analysis, stewardship of investee companies, and sustainable finance policy engagement.

“The data shows that while they may talk the talk, most asset managers are not walking the walk when it comes to using their influence to drive real change in investee companies and sustainable finance policy,” said FinanceMap’s Daan Van Acker.

Overall, the portfolios of the world’s 45 largest asset managers, which collectively hold $72tr in assets under management (AUM), are misaligned with Paris Agreement goals. Of the equity fund portfolios assessed, 95 per cent are misaligned with the IEA Net Zero Emissions by 2050 Scenario.

All three of the world’s largest asset managers are not fully aligned to Paris (BlackRock, Vanguard and Fidelity Investments) and the three least aligned are Ping An Group, Mitsubishi UFJ Financial Group and Sumitomo Mitsui Trust Holdings.

Collectively, the asset managers hold 2.8 times more equity value in fossil fuel production companies than in green investments in the assessed sample and while US asset managers have always lagged their European competitors, this year, US asset managers appear to have pulled back even further on their ambition in top-line climate messaging, as well as in their company engagements and resolution voting. This shift has occurred amidst an ‘anti-ESG’ trend in over fifteen state legislatures.

Meanwhile, European asset managers top the chart when it comes to engagement with investee companies on climate, with Legal & General Investment Management heading the table.

All asset management firms analysed in the study were consulted by FinanceMap on their results prior to release.

Latest News

-

Bingo firm raises £300,000 for the Stroke Association

-

Sainsbury’s links up with Comic Relief for festive recipe campaign

-

Shepherd Neame extends air ambulance charity partnership

-

Businesses help festive match funder raise a record £57.4m

-

Firms help fund regional mayors' initiatives to tackle childhood inequality

-

Retailer raises more than £16,000 for Down’s Syndrome group

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories