The EU’s import taxes on carbon-intensive products will have only a limited impact on climate change and a modest negative effect on economies in Asia and the Pacific, according to research by the Asian Development Bank (ADB).

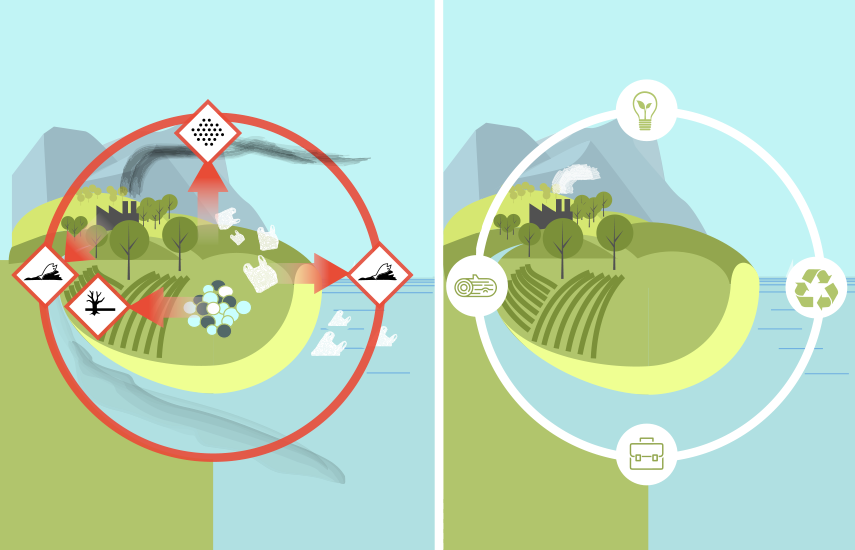

The EU’s Carbon Border Adjustment Mechanism (CBAM), set to go into force in 2026, will impose import charges on products such as steel, cement, and electricity, based on the carbon dioxide emissions embedded in their production. The charges are aimed at curbing “carbon leakage,” the result of polluters moving production from countries with stringent regulations or high carbon prices to those with less stringent regulations or lower prices.

However, ADB predicts that CBAM is likely to reduce global carbon emissions by less than 0.2 per cent relative to an emissions trading scheme with a carbon price of $108 per metric tonne and no carbon tariff, statistical modelling shows.

“The fragmented nature of carbon pricing initiatives in terms of sectors and regions covered, including CBAM, can only partially limit carbon leakage,” said ADB chief economist Albert Park. “To significantly reduce carbon emissions globally, while also making sure climate efforts are more effective and sustainable, carbon pricing initiatives need to be extended to other regions outside the EU, especially Asia.”

Latest News

-

Jaguar Land Rover launches Foundation to support youth charities

-

Tesco partners with charity and suppliers to tackle hygiene poverty

-

Channel 4 offers free advertising airtime to B Corp firms

-

Vodafone partners with Save the Children for online safety scheme

-

Charities to get £40m from funds raised by rule breaking energy firms

-

Airport links up with education and children's charities

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories