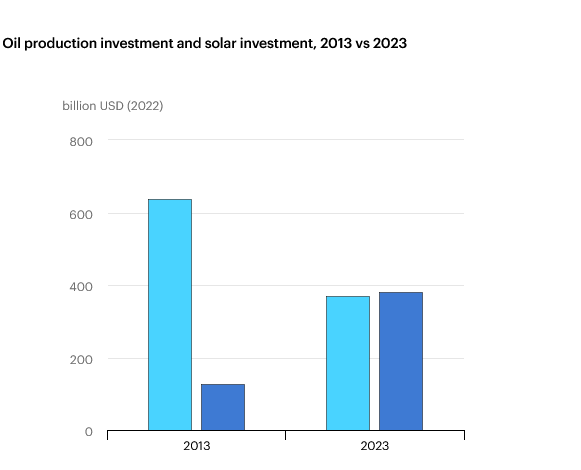

Annual spending on solar and wind projects has risen by more than $300bn in the past five years, benefitting from policy support and cost declines. In 2023, it's set to account for a third of the expected $1.8tr in overall clean energy investment.

However, the IEA predicts that renewable investors are now grappling with two strong headwinds. Volatile commodity prices and supply chain constraints have interrupted the extended run of cost declines for key clean energy technologies. Meanwhile, the sharp rise in interest rates globally, aimed at containing inflation, is pushing up the cost of capital after a long period when accessing financing was relatively cheap.

These trends are exposing the clean energy industry to new challenges and, in some cases, extreme financial pressure. Signs of strain have been particularly apparent in the wind sector, as well as in emerging and developing economies, where the rising cost of capital is particularly sharp and could threaten clean energy transitions, according to the commentary.

The IEA sees solutions to these issues if policy makers rethink the design of auctions and tenders, boost confidence in the reliability of demand, and address the factors that make the run-up in financing costs even worse in the developing world.

Latest News

-

Bingo firm raises £300,000 for the Stroke Association

-

Sainsbury’s links up with Comic Relief for festive recipe campaign

-

Shepherd Neame extends air ambulance charity partnership

-

Businesses help festive match funder raise a record £57.4m

-

Firms help fund regional mayors' initiatives to tackle childhood inequality

-

Retailer raises more than £16,000 for Down’s Syndrome group

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories